The Ultimate

Motor Insurance

Get comprehensive car insurance with optional add-ons for total peace of mind.

Motor Third Party policy

Our Motor Third Party policy indemnifies the insured and any permitted driver in respect of legal liability to third parties for death, injury or property damage. The minimum limit for damage to property is GH¢5,000.00 and could be reviewed upwards at the request of the insured by paying additional premium.

OUR ADVANTAGES / FEATURES

Subject to the limits specified in the policy, and within the limit of the value of the property, and the capital subscribed, ACTIVA shall cover :

-

Damage caused by your vehicle to others to their person or their property

-

Death/ injury suffered by the passengers on board your vehicle

HOW TO ACCESS OUR MOTOR INSURANCE POLICIES

Online:

-

Complete an application form online at https://www.group-activa.com/ghana/

-

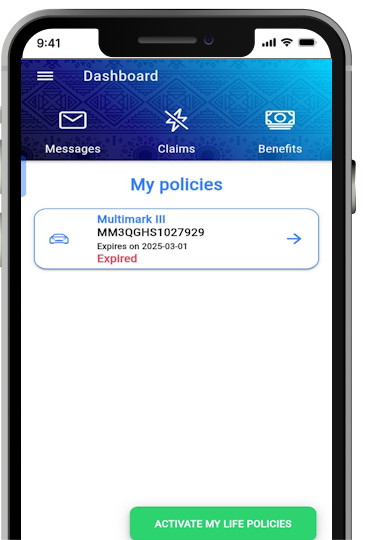

Download the Activa Online application from Google Playstore or IOS to buy or renew your insurance policy.

Walk in

-

Complete a proposal form

-

Attach a photocopy of your ID Card or Driver’s license,

-

The amount of the premium will depend on the Cubic capacity (horsepower) age of the vehicle, duration of cover, and use of the vehicle (personal or commercial use)

-

Either Pay Premium via Mobile Money, bank transfer, cash or cheque.

Motor third party fire And theft

In addition to the cover provided by the Third Party Policy described above, this policy provides cover for damage to the insured’s vehicle itself for fire or theft.

HOW TO ACCESS OUR MOTOR INSURANCE POLICIES

Online:

-

Complete an application form online at https://www.group-activa.com/ghana/

-

•Download the Activa Online application from Google Playstore or IOS to buy or renew your insurance policy.

Walk in:

-

Complete a proposal form.

-

Attach a photocopy of your ID Card or Driver’s license,

-

The amount of the premium will depend on the Cubic capacity (horsepower) age of the vehicle, duration of cover, and use of the vehicle (personal or commercial use)

-

Either Pay Premium via Mobile Money, bank transfer, cash or cheque.

MOTOR COMPREHENSIVE

OUR SOLUTION: In addition to Third Party, Third Party Fire and Theft, the comprehensive motor insurance also provides cover for damages to your own vehicle.

KEY ADVANTAGES / FEATURES

Subject to the limits specified in the policy and within the limit of the value of your vehicle, ACTIVA shall cover:

-

Loss or damage to your vehicle and/or accessories caused by or arising from an accidental collision, etc

-

Damage caused to third parties by your own vehicle.

-

Badly injury suffered by the Driver and or all authorized persons in your vehicle.

-

The minimum limit for damage to property is GH¢5,000.00 and could be reviewed upwards at the request of the insured by paying additional premium

Please refer to NDIC Ghana’s deposit protection guidelines or contact ACTIVA Internationa Insurace or NDIC directly (visit www.ndic.gov.gh).

2 Maurice Yameogo Rd Opposite North Ridge Lyceum School, GA-015-9114, PMB KIA 85, Airport, Accra, Ghana.

0800377477

Toll Free

Customer Care (Mon-Fri, 8am-5pm)

(233) 302 686 352

Request

(233) 302 685 118

(233) 257 370 377

info.gh@group-activa.com

© 2026 Group ACTIVA. All rights reserved